According to Mobilesquared research and forecasts, the top 10 CPaaS providers in 2022 will account for 65.7% of total brand CPaaS spend. All of the top 10 companies are expected to announce CPaaS revenues in excess of $1 billion for 2022/financial year 2022. `

By 2026 the market will have broadened slightly, with the top 10 CPaaS providers accounting for 63.7% of total brand CPaaS spend, the top 20 accounting for 81.6%, and the top 30 accounting for 87.4%.

By 2026 the market will have broadened slightly, with the top 10 CPaaS providers accounting for 63.7% of total brand CPaaS spend, the top 20 accounting for 81.6%, and the top 30 accounting for 87.4%.

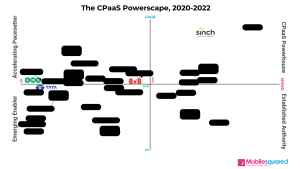

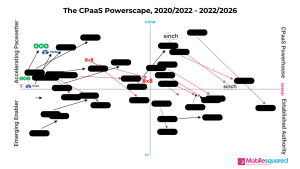

To put this growth into context, Mobilesquared has created the CPaaS Powerscape to provide a clear understanding of where companies sit within the CPaaS market in terms of position and potential. To create the CPaaS Powerscape, we have applied each company’s CAGR for a given period to their average annual revenues over the same period.

We have created four categories, which when plotted over time reveals their path to CPaaS maturity. The categories are:

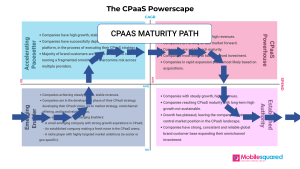

Emerging Enabler = These companies are achieving steady growth and stable revenues, and potentially hold an influential emerging role within the CPaaS Powerscape, depending on their company type.

Emerging Enabler = These companies are achieving steady growth and stable revenues, and potentially hold an influential emerging role within the CPaaS Powerscape, depending on their company type.

Accelerating Pacesetter = These are high growth companies with stable revenues. These companies have successfully deployed their omnichannel platform, and are in the process of executing their CPaaS strategy by focusing on the significant expansion of their customer base.

CPaaS Powerhouse = These are companies with high growth and high revenues that are driving the CPaaS market forward. These companies are yet to reach maturity, are currently in rapid expansion phase and most likely acquisition mode.

Established Authority = These are mature companies with steady growth and high revenues. Their growth trajectory is forecast to flatten in the longer-term, leaving these companies in a stable and central market position in the CPaaS landscape, enjoying high revenues based on a strong, consistent and reliable global brand customer base.

Of the CPaaS providers included in the CPaaS Powerscape, based on average spend and CAGR for the three-year period, 18 would be categorised as “Emerging Enabler” CPaaS providers, 10 would be “Accelerating Pacesetters”, four as “Established Authorities”, and six as “CpaaS Powerhouses”.

Between our forecast period of 2022 and 2026, of the 38 CPaaS providers, 14 would be categorised as “Emerging Enabler” CPaaS providers, 14 would be “Accelerating Pacesetters”, seven as “Established Authority” CPaaS providers, and 3 as “CPaaS Powerhouses”.

Between our forecast period of 2022 and 2026, of the 38 CPaaS providers, 14 would be categorised as “Emerging Enabler” CPaaS providers, 14 would be “Accelerating Pacesetters”, seven as “Established Authority” CPaaS providers, and 3 as “CPaaS Powerhouses”.

Mobilesquared’s defines CPaaS as “the capability to provide real-time, cloud-based omnichannel communications via an API to connect brands and consumers at scale”.

CPaaS 2020-2026: The path to brand/consumer engagement is available now. Full report costs £4,990 and includes 100-page interactive report and dataset with 1 million + data points. Mobilesquared now offers a Pay-As-You-Go data service, so you can also only buy the CPaaS data you need.

More information can be found here: Buy CPAAS Data.

About Mobilesquared

Mobilesquared is the established #1 global authority on business messaging and CPaaS, with our data shaping business plans, strategy, and customer engagement modeling, for some of the world’s leading brands, mobile operators, and the messaging ecosystem.