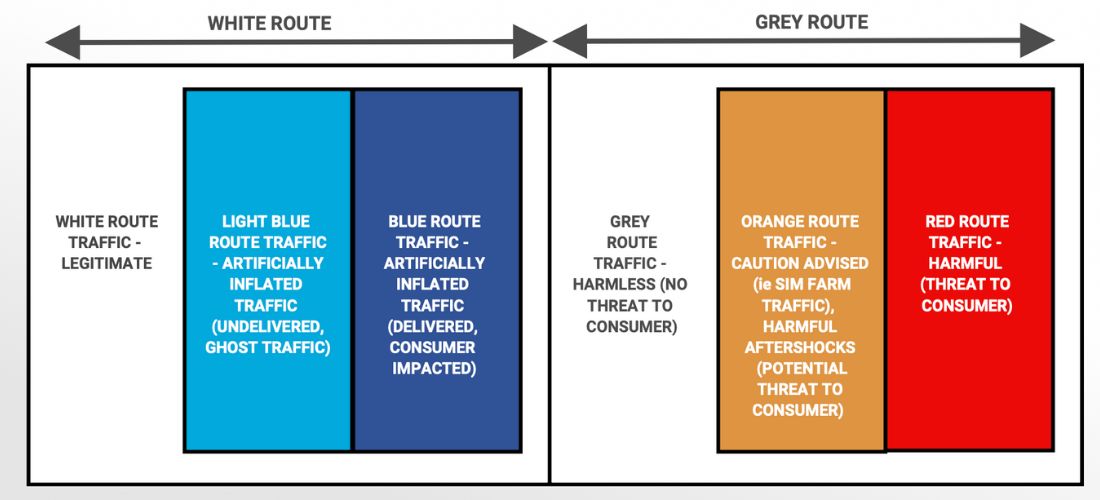

A2P SMS traffic has historically always been split between white and grey traffic, but Mobilesquared believes this is no longer a sufficient breakdown of the traffic traversing mobile operator networks.

We have introduced the rainbow traffic to better highlight the impact these different traffic types have, not only on the mobile operator but also on businesses and consumers alike. We believe it’s time to look at the market through a new lens.

White route SMS traffic is recognised as official traffic between two mobile operators resulting in the terminating mobile operator being paid for the successful delivery of a message to one of its subscribers.

A grey route is when the terminating mobile operator does not receive payment for the successful delivery of a message to one of its subscribers – and is kept by the aggregator. The terminating mobile operator has been bypassed.

A2P SMS traffic has historically always been split between white and grey traffic, but Mobilesquared believes this is no longer a sufficient breakdown of the traffic traversing mobile operator networks.

Based on the latest A2P SMS global forecasts from Mobilesquared, released at the start of July, grey route traffic still accounted for around 25% of total traffic in 2022 and is increasing (when it should be shrinking, but that is related to a much bigger issue impacting the SMS industry and is tackled in great detail in the report).

From a mobile operator perspective, they are not receiving payment for the delivery of 25% of the total global A2P SMS traffic. In other words, through a mobile operator’s lens, 25% of total A2P SMS traffic in 2022 was fraudulent.

Until now, grey route traffic has always been closely associated with fraudulent traffic. However, if we look through the lens of a business or a consumer, not all of the grey route traffic is fraudulent, and therefore should not be considered harmful to either the consumer or the business.

For instance, at the lower end of the scale, grey route traffic can be used by messaging providers (for example) to create a blended rate (white route + grey route) to meet the pricing requirements of a business. An example scenario might be where a business might refuse to pay higher than $0.04 per message for traffic into a particular market, even though the basic rate for that market is $0.08 per message.

A messaging provider will blend white route traffic with the lower-priced grey route traffic to create a blended rate to meet the client’s requirements. In such an instance, grey route traffic is an essential negotiating tool to help drive down costs for businesses.

To cater for this type of traffic, Mobilesquared will refer to it as “harmless grey traffic”. Similarly, Mobilesquared has placed “spam” within this category also.

For instance, the majority of business emails in a personal email account are considered spam but not harmful. By including spam within our “grey harmless traffic” term, we are categorising SMS spam traffic in the same way we do with email, especially as these channels become more closely intertwined through CPaaS (Communications Platform as a Service).

Until now, grey route traffic has always been closely associated with fraudulent traffic. However, if we look through the lens of a business or a consumer, not all of the grey route traffic is fraudulent, and therefore should not be considered harmful to either the consumer or the business.

To expand on the different traffic types, Mobilesquared has applied a rainbow of colours that better reflects how certain traffic types can impact the business sending the message and the consumer receiving the message.

We define orange traffic as “SMS traffic that is potentially harmful to the consumer”. A typical example would be SIM farm/SIM box traffic that is carrying harmless marketing and promotional traffic to the consumer. However, the company operating the SIM farm could then use the data applied or extracted from the campaign in a potentially harmful way for the next campaign.

Red traffic is “SMS traffic that poses a potential or real threat to the consumer and potentially damages the sender business’ brand reputation.” The red traffic classification includes phishing, account take-over, sender identity change, SIM swap, and SMS malware.

However, it’s not just grey that is attracting fraudulent traffic. Fraudsters are now willing to pay the full white route traffic rate because there is often a very compelling return on their fraudulent investment (ROFI). Just like grey before it, white too has different shades of white.

As fraudsters generate more revenue from illegitimate activities, they are now paying white route traffic rates to disseminate their fraudulent traffic. Artificially Inflated Traffic (AIT), Artificially Generated Traffic (AGT), and Trashing are examples of white route traffic fraud, and to differentiate these practices from white route traffic, Mobilesquared has labelled this traffic “blue”.

Mobilesquared does not expect all of the messaging industry to embrace our new approach and the definitions we are applying to traffic types, and that is why we have maintained the white and grey route traffic types as umbrella terms.

That said, Mobilesquared believes our revised approach will help bring greater clarity to what is occurring in the industry, using the power of colours to greater reflect what that traffic actually denotes. For example, we’ve already highlighted the levels of fraud from a mobile operator’s perspective (25%), but if we just look at it from a consumer perspective, the levels of fraud in 2022 were 13% of total traffic.

As such, we at Mobilesquared believe that this is a far healthier way of looking at the A2P SMS market.

Mobilesquared believes our revised approach will help bring greater clarity to what is occurring in the industry, using the power of colours to greater reflect what that traffic actually denotes.

How We Can Help

We are Mobilesquared: mobile engagement specialists delivering the very best independent mobile market intelligence to our clients.

We are the established #1 global authority on business messaging and CPaaS, with our data shaping business plans, strategy, and customer engagement modelling, for some of the world’s leading brands, mobile operators, and messaging providers.

To learn more about our services, including the Messageverse, be sure to get in touch via telephone (01182149 777) or email (info@mobilesquared.co.uk) to find out about what we do and discover how we can help your business.