WhatsApp Business will become a billion-dollar platform in 2024, according to Mobilesquared’s latest forecasts (published April 2024), with a period of consistent growth up to 2026, before astronomical growth from 2027 onwards as brands finally embrace rich messaging as a core channel as part of their omnichannel strategy.

Just to be clear, we are referring to WhatsApp Business API, which is the commercial element of WhatsApp’s business messaging, serving medium and large companies via an API either with WhatsApp direct or a WhatsApp partner (CPaaS partner, aggregator etc). (The WhatsApp Business app is a free messaging service for small and micro companies.)

Mobilesquared, recognised as global #1 messaging market analysts, believes there are 6 reasons as to why 2024 is WhatsApp’s breakthrough year.

- It has spent 6 years seeding the marketplace for WhatsApp Business, educating brands how to use the channel, whilst laying the foundation for its future growth.

- Brands must complete a strict verification process and follow stringent channel usage guidelines.

- The implementation of a strict WhatsApp user opt-in model guarantees brands proactively develop and maintain their database, while protecting the channel (and users) from fraudulent traffic.

- The four use cases are simple, well-defined, and understood by brands.

- The introduction of a simple pricing model for each market.

- On-going turbulence in the A2P SMS marketplace caused by high international termination rates and artificially inflated traffic (AIT) is:

- Driving the migration of A2P SMS onto WhatsApp

- Expediting brands’ adoption of WhatsApp.

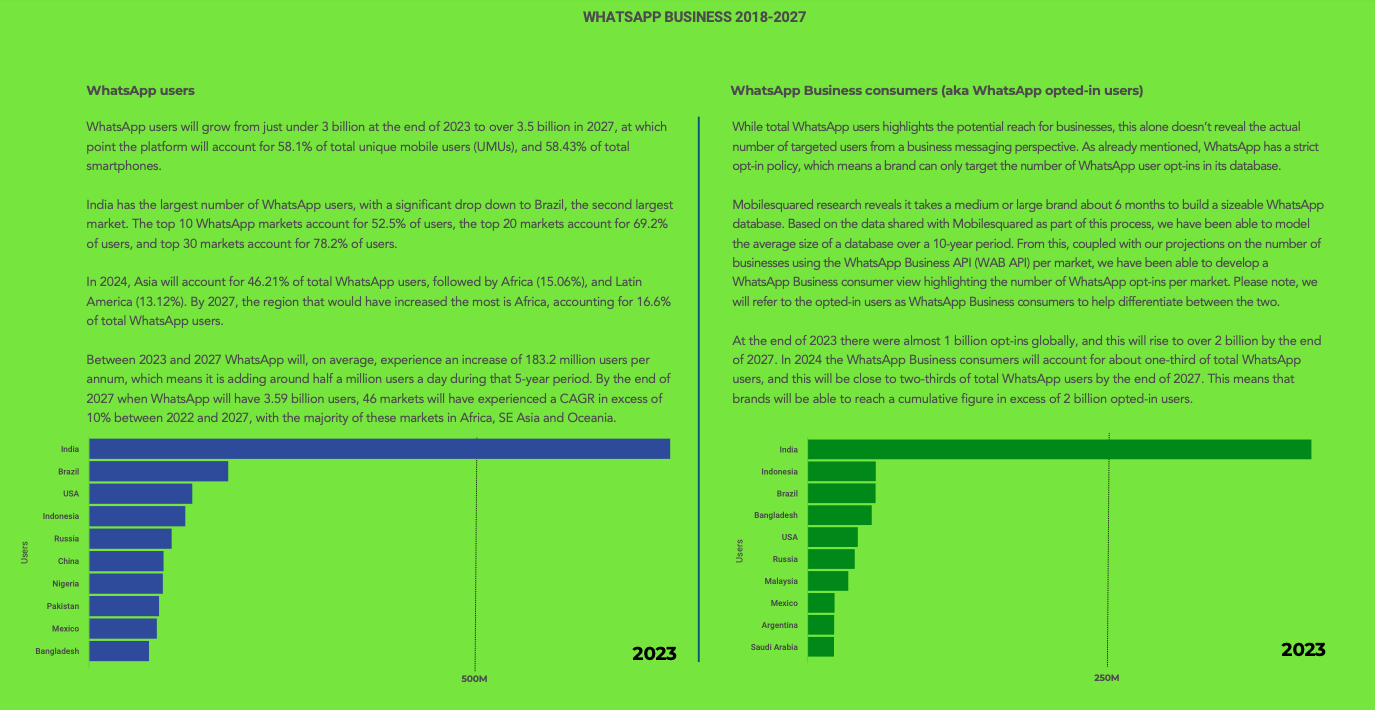

WhatsApp users will grow from 2.87 billion at the end of 2023 to 3.59 billion in 2027, at which point the platform will account for 58.1% of total unique mobile users (UMUs), and 58.43% of total smartphones. India has the largest number of WhatsApp users, accounting for almost one-quarter of total WhatsApp users, followed by Brazil.

(Image: Mobilesquared, WhatsApp market research 2024)

It is this scale that is initially attracting brands to explore using WhatsApp Business API, but brands can only engage with a WhatsApp user when they have opted-in to do so.

Mobilesquared believes that close to one-third of WhatsApp users globally have opted-in to allow engagement with at least one brand, and this will increase to almost two-thirds of total WhatsApp users by the end of 2027. This means that brands will be able to reach a cumulative figure in excess of 2 billion opted-in users.

For the time being, brand adoption remains low. In fact, less than 0.5% of medium and large businesses (based on global registered businesses) are using WhatsApp Business API. By the end of the forecast period in 2027, that figure has only increased to 1.1% of the total, however, the amount of traffic they will generate will be on a similar level to A2P SMS.

In 2023, an average of around 11 billion WhatsApp business messages were being exchanged between brands and consumers per month, and that will jump to around an average monthly figure of 170 billion by 2027.

Asia and Latin America are, and will remain so dominant in terms of their share of global WhatsApp business traffic, that combined they accounted for 96.8% of total global traffic in 2023, and will account for around 90% in 2027.

Two-way, conversational message traffic will dominate WhatsApp Business API traffic. In 2023, total conversational messages (i.e. total messages exchanged between a brand and consumer) accounted for more than three-quarters of total traffic, with A2P messages accounting for the majority of the remaining traffic, and P2A message traffic

By 2027, both A2P and P2A share of traffic have grown, but not sufficiently to impact greatly on total conversational message’s dominance, which will still account for around two-thirds of total global traffic.

When splitting the traffic out by use case, conversational services (aka customer care) accounted for almost three-quarters of total global traffic in 2023, followed by utility and marketing.

Authentication accounted for less than 1% of total traffic in 2023, even though there was an acceleration in traffic migrating from A2P SMS onto WhatsApp where markets have high SMS termination rates. In 2022, the traffic that migrated from SMS onto WhatsApp Business API accounted for 4.34% of total traffic, but in 2023 it accounted for 23.43% of total traffic.

Mobilesquared predicts brand usage of the channel will evolve over the forecast period. Conversational services share of total traffic will drop significantly, as usage customer services to multi-purpose, with marketing to account for 28.74% of total traffic, utility 19.23%, and authentication 9.55%.

Looking at the bigger picture, by 2027 WhatsApp Business API should be considered as not only a mainstream channel within the CPaaS, but as the core channel upon which major growth within the CPaaS will emanate from.

Please contact our analyst team for comment or insight at nick@mobilesquared.co.uk and find out more about what our WhatsApp research includes here.