Here’s the thing with RCS, it could be big. As in really, really big. I’m not talking about RCS from a peer-to-peer usage, I’m talking about its potential to connect businesses with consumers.

Yes, yes, yes, I know we’ve been talking about it for years as an industry, but something is finally happening with RCS, although we’ll say it quietly for now.

The Elephant in the Room: RCS vs WhatsApp

Let’s firstly discount the elephant in the room before we talk about the fruit. The number of RCS vs WhatsApp users is irrelevant from a business messaging perspective (and that’s the elephant). Saying WhatsApp has around 3 billion users (which it does) is a great marketing ploy, but every business and brand using WhatsApp Business has to create a bespoke purpose-built opted-in WhatsApp user database to communicate with each and every single user. So the 3 billion figure is irrelevant.

RCS business messaging (RBM) can use existing mobile databases used for A2P SMS. What’s more, when you add Apple iOS users (that’s the fruit) to the RCS mix, RCS has a greater penetration than WhatsApp. In fact, RCS-i as we have labelled it (that is Android RCS + iOS RCS users) gives an almost SMS-like ubiquity in the majority of markets around the world. Now brands are starting to get interested!

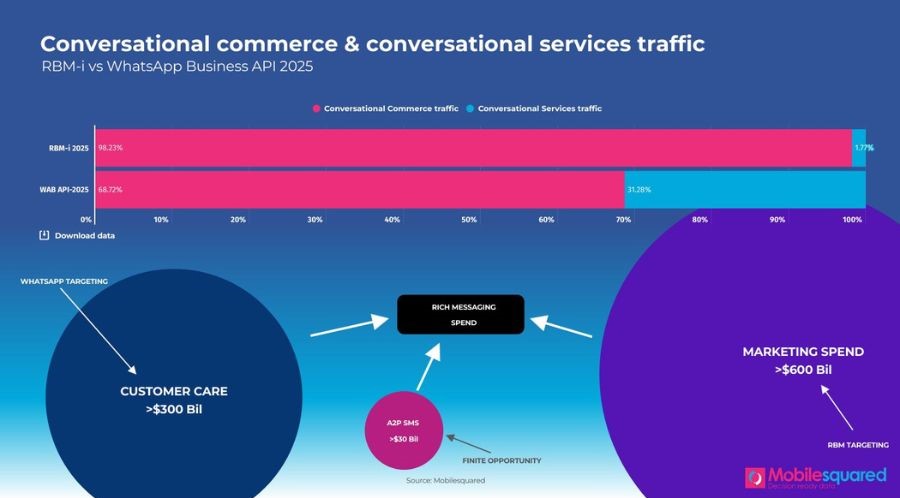

But let’s get back on track. That really, really big opportunity. With it’s pricing strategy, WhatsAppp Business is clearly targeting utility-based traffic and the conversion of voice-based customer care traffic onto chat. Meta refers to WhatsApp Business as “chat”. And brands and businesses are starting to buy into this concept. It is now a billion $ plus channel.

Furthermore, Meta has targeted the customer care market for chat. The customer care market is said to be worth upwards of $300 billion (third-party numbers, not Mobilesquared), regardless, that is almost 10x the size of the A2P SMS market.

So actually, when people and companies constantly ask Mobilesquared: can WhatsApp replace SMS? That is only a small component of a much bigger strategy. And yes, WhatsApp Business has replaced some of the A2P SMS traffic, and will continue to do so, but that is not the endgame for Meta.

That potentially leaves RBM with a clear run to become the marketing messaging channel of choice – after all, prior to the industry going acronym-mad, A2P SMS was known as “mobile marketing” about 15 years ago. And this is where the really, really big opportunity comes from. According to Dentsu, global digital advertising spend will top $754 billion in 2024.

That means that brands will spend an average of $92.86 per person using digital advertising in 2024. In comparison, brands will spend an average of $4 per person over A2P SMS in 2024.

As Mobilesquared has been highlighting for about 6 years, a number of the channels operating under the digital advertising umbrella offer a very poor performance to brands (banner advertising is the obvious one, yet brands continue to spend billions on the channel).

Conversational commerce & conversational services traffic: RBM-i vs WhatsApp Business API 2025

Reimagining RCS

The focus should be on encouraging the migration of brand spend from digital advertising onto RBM, not becoming too fixated on “Is RCS replacing SMS?”

Companies operating in the RCS space need to think bigger, beyond A2P SMS. We (Mobilesquared) have been saying for years that the RCS community are constrained in their thinking by SMS. Also why saying RCS is SMS 2.0, or SMS Advanced, limits how RCS can actually be positioned to brands and businesses.

In any other industry, if there was an opportunity of tapping into a $700 billion industry, start-ups would be flocking around investors seeking funds to unlock that goldmine. That is not the case in messaging. Mobile operators are typically investing in IoT and 5G, with their messaging teams operating on a shoestring. Until messaging stops being viewed as the poor relation within mobile operators, that is unlikely to change.

It’s time to approach RCS differently. As a new channel. RCS needs to become a thing. A decent name and a logo would be a good start, but developing a start-up mentality to tackle the opportunity would be better.

For more insights on how RCS can transform messaging, contact nick@mobilesquared.co.uk.