Our CPaaS data contains just over 500,000 searchable and downloadable datapoints, and delivers a comprehensive global, and national view of 14 channels across 200 markets, to 2026 (with updates to 2028 coming 2H24).

Traffic for the omnichannel covers inbound (P2A), outbound (A2P) traffic, and conversational traffic across all 14 channels where applicable.

Spend is based on all traffic types, use case, sector and, new in 2024, customer care and conversational commerce.

Traffic and spend are also split out by use case, and further divided by sector, as well as customer care and conversational commerce.

This subscription also includes our 100-page CPaaS anallyst report, delivering in-depth analysis of the global and regional market.

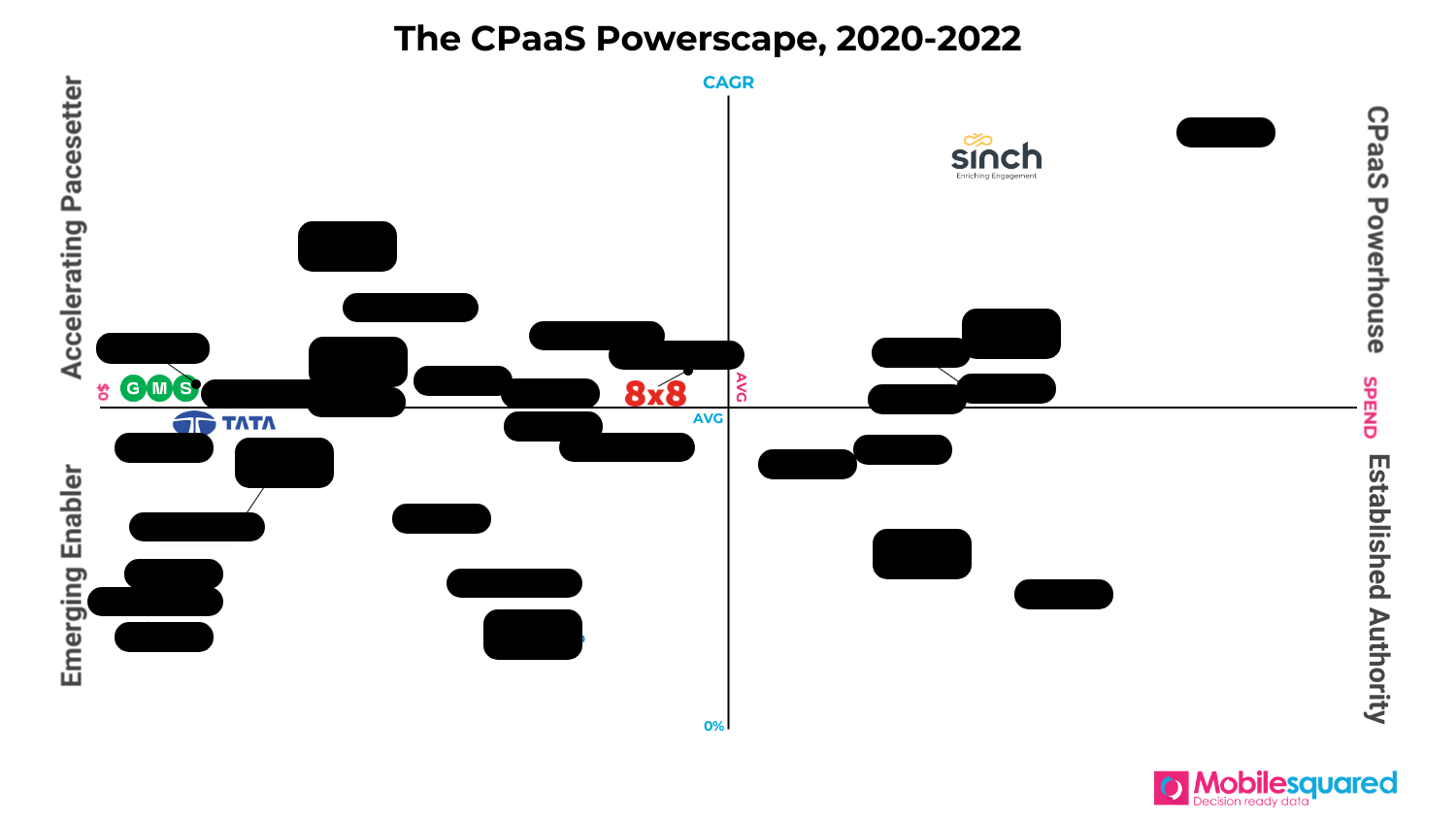

The report also features the CPaaS Powerscape – identifying the top 30 CPaaS providers and their forecast growth trajectory over the forecast period. This is not a vanity play, but based on Mobilesquared’s independent understanding of market growth applied to individual companies.

Channels covered: SMS / MMS / RCS / WhatsApp / Apple Messages for Business / Viber / Facebook Messenger / OTT – Other messaging platforms (WeChat, Line, Kakao, etc) / Voice / Video / In-app push notification / Social media / Web / Email.

Data included: Data and forecasts for all of the 200 markets/ 14 channels covered, is split out by total users by channel / Total users as % of smartphone users / Total users as % of total UMUs / Total traffic by channel / Average traffic per user by channel / Total spend by channel / Average spend per user by channel.

CPaaS Powerscape includes; CPaaS providers split by Emerging Enabler, Accelerating Pacesetter, CPaaS Powerhouse, and Established Authority.

Markets covered: Our dataset covers the top 200 markets from around the world. Top 30 markets by spend include Argentina / Australia / Bangladesh / Brazil / Canada / China / Egypt / France / Germany / India / Indonesia / Italy / Japan / Mexico / Netherlands / Nigeria / Pakistan / Philippines / Russia / Saudi Arabia / South Korea / Spain / Sri Lanka / Sweden / Switzerland / Taiwan / Turkey / United Kingdom / USA / Vietnam.

CPaaS Users: For each of the 200 markets we cover, our CPaaS user data is split by total unique mobile users (UMUs) / total mobile subscriptions / total users split out by device type: smartphone by OS/non-smartphone. User data is further split out by gender and age.

Sectors: Automotive / Broadcasters / Charity / Education / Enterprise software / Finance / Gambling / Healthcare / Internet streaming / Leisure & entertainment / Public services / Restaurants & fast-food / Retail & eCommerce / Social media & chat / Telecoms / Transport & logistics / Travel & tourism / Utilities / Other.

Companies researched: We received CPaaS market data and insight from over 100 companies, including mobile operators and aggregators, CSPs, vendors, hub providers, interconnect providers, and firewall providers. These companies include:

Adaptive Mobile / Aegis Mobile / AI Cross / Alchemy / Anam / Apprentice Valley / Arelion / Bandwidth / BICS / Bouygues Telecom / BT/EE / Bulk SMS / Cheetah Mobile / Cisco / Comviva / Deutsche Telekom / Enabld / Etisalat / Fonix Mobile / Global Point / GMS / / Google / GTC / GTS / Gupshup / Haud / iBasis / iConectiv / iTouch Messaging / Kaleyra / Karix / Lanck Telecom / LINK Mobility / Mavenir / Melita / MessageBird / Messagio / Meta / Millicom / Mitto / MMDSmart / Mobivity / Modica Group / Monty Mobile / Movitext / MTN Global Connect / MTN Irancell / MTN Nigeria / O2 / Ooredoo / Orange / Out There Media / Oxygen8 / PolkomTel / Quiubas Mobile / Reliance Communication / Route Mobile / Salesforce / SFR / Sinch / Softbank / Soprano / STC / Summit Tech / Sunrise / Swisscom / Synchronoss / Syniverse / Tanla / Tata / Telefonica Group / Telenor / Telesign / Telia / Telia Carrier / Telnyx / Thales / Three / Three Ireland / TI Sparkle / T-Mobile / T-Mobile US / Tomia Global / True Corporation / Tunisie Telecom / Turk Telekom International / Twilio / TWW / Tyntec / Unifonic / Vibes / Viber / VimpelCom / Vodafone / Vonage / Wavy / WhatsApp / WMC Global / XConnect / Zain.